Elon Musk's recent posts on X showcase exciting advancements in Tesla's humanoid robot, Optimus, and provide an optimistic update on the upcoming Full Self-Driving (FSD) software version 14. These positive developments reinforce Tesla's leadership in robotics and autonomous technologies, positioning the company for substantial growth and innovation, particularly as it builds on its record-setting deliveries in the third quarter of 2025.

Last minute bug cropped up with V14. Released is pushed to Monday, but that gives us time to add a few more features.

— Elon Musk (@elonmusk) October 4, 2025

X Summaries

In one post, Elon Musk shared an impressive video of Tesla's Optimus robot learning Kung Fu moves, mirroring human trainers in a lab by adopting defensive stances and performing fluid motions with remarkable balance. This demonstration highlights the robot's advanced learning through simulation-to-real transfer, and Musk clarified in a reply that it was powered entirely by AI, not tele-operation, emphasizing the autonomous nature of the technology. In another post, Musk addressed the FSD version 14 rollout, noting that last-minute checks for a minor bug are being conducted ahead of its release on Monday, October 6, 2025. He highlighted the silver lining, explaining that this provides extra time to incorporate additional features, turning the final preparations into an opportunity for enhancement.

Tesla Optimus learning Kung Fu pic.twitter.com/ziEuiiKWn7

— Elon Musk (@elonmusk) October 4, 2025

Optimus Progress and Market Context

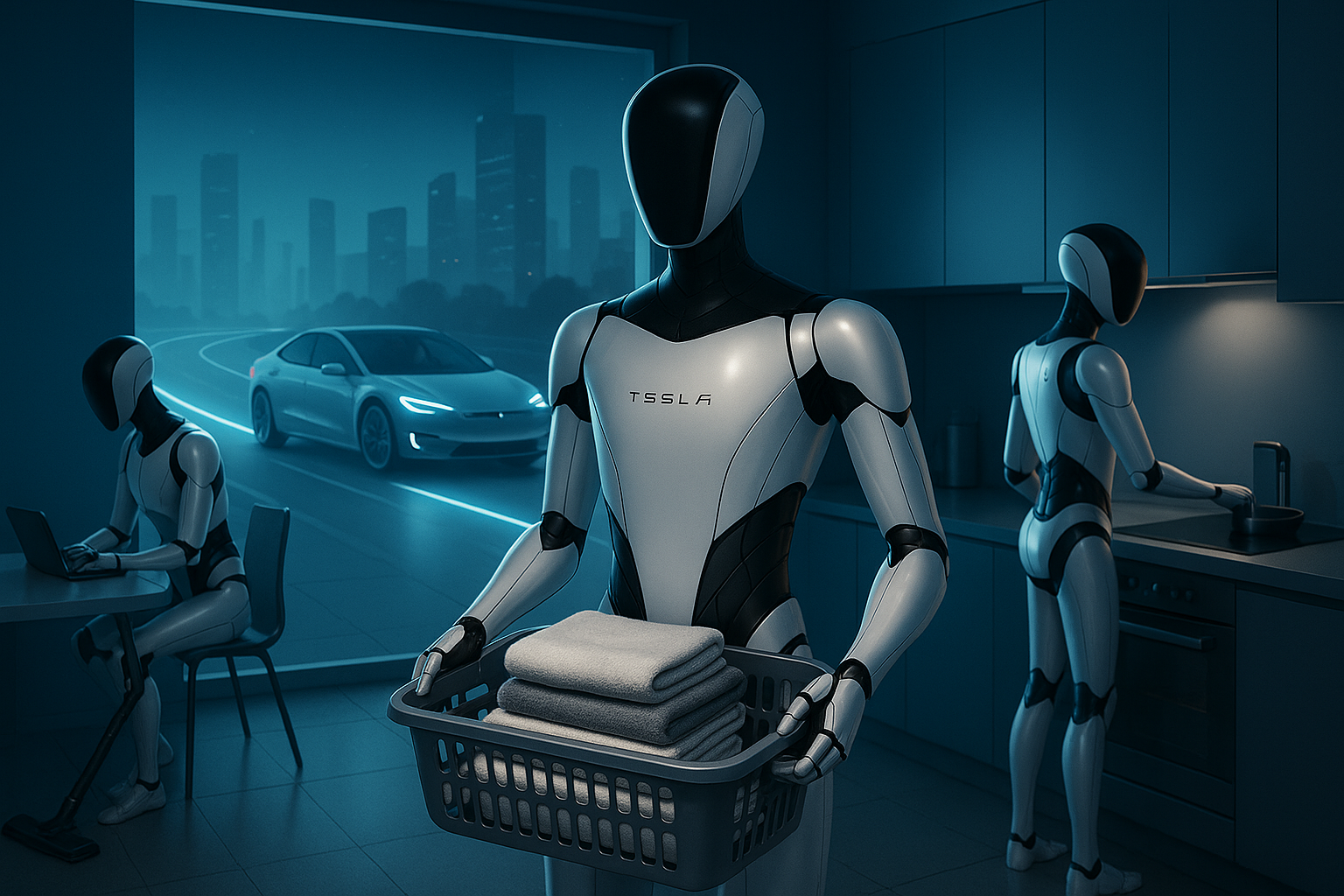

The Kung Fu demonstration marks a thrilling milestone for Optimus, Tesla's groundbreaking humanoid robotics initiative designed to handle factory tasks and expand into everyday applications. By showcasing improved dexterity, balance, and AI-driven learning, this update signals Tesla's rapid progress in creating versatile robots that could revolutionize industries. Musk has envisioned Optimus as a cornerstone of Tesla's future, potentially contributing up to 80 percent of the company's valuation and propelling it toward a $25 trillion market cap. Looking ahead, Tesla plans to roll out limited production of Optimus in 2025, aiming for thousands of units, with a significant ramp-up to tens of thousands by 2026 for internal deployment and eventual external sales.

This opens up an entirely new market for Tesla beyond electric vehicles, tapping into the burgeoning demand for humanoid robots in manufacturing, logistics, and household assistance, which could generate billions in revenue and diversify Tesla's portfolio. While competitors like China's Unitree offer affordable alternatives, such as the $5,900 R1 robot with agile capabilities including Kung Fu maneuvers, Tesla's integration of advanced AI and ecosystem synergies give Optimus a competitive edge. Musk has also teased Optimus version 3 as something extraordinary, with ongoing tests like solving Rubik's Cubes while juggling to refine its capabilities, further fueling excitement for its long-term potential.

FSD V14 Update and Autonomy Outlook

The update on FSD version 14 reflects Musk's commitment to delivering a polished product, with final checks ensuring reliability before its Monday release. Described as the second-most significant upgrade since version 12, it boasts a tenfold increase in parameters, reduced driver interventions, and a more intuitive, "sentient" experience by version 14.2. The rollout strategy includes an early wide release of version 14.0 next week, followed by 14.1 in about two weeks, and 14.2 soon after, building anticipation among users. Tesla's Robotaxi fleet already operates with unsupervised FSD, while public versions prioritize safety through supervision. This positive framing aligns with broader advancements, such as the AI5 chips expected in 2026, which offer 40 times the performance of AI4, paving the way for true full autonomy and enhancing Tesla's edge in the self-driving market.

Stock Implications

TSLA closed at $429.83 on October 3, 2025, after a modest dip of about 1.4 percent from the previous day's close of $436.00, reflecting some market volatility but maintaining resilience amid strong fundamentals. The third quarter of 2025 delivered a boost with record vehicle deliveries of 497,099 units, up significantly from the second quarter's 384,000, alongside production of 447,450 vehicles that helped streamline inventory.

Energy storage deployments reached an impressive 12.5 GWh, underscoring diversified growth. In the short term, the Optimus demo and FSD preparations inject positive momentum, countering any minor fluctuations, especially with surges driven by expiring $7,500 U.S. EV tax credits and rebounds in European sales, including a 2.7 percent increase in France for September. While Tesla's U.S. EV market share has faced competition from rivals like BYD and Volkswagen, dipping in recent quarters, the company's overall dominance persists with models like the Model Y leading registrations.

Long-term, these tweets highlight Tesla's transformative potential: Optimus not only demonstrates cutting-edge AI but also unlocks vast new markets in robotics, potentially adding trillions to valuation as production scales. Analysts' price targets for TSLA range from $120 to $600, with bullish outlooks from firms like Wedbush projecting up to an $8.5 trillion market cap fueled by autonomy and robots.

Despite risks such as talent retention, legal matters like Cybertruck-related lawsuits, and external factors including Musk's political engagements affecting regions like Europe, Tesla's innovative trajectory positions it as a high-reward investment. With 2025 vehicle deliveries projected at around 1.61 million—a slight adjustment from prior years but supported by expanding markets—the focus on robotics and AI suggests substantial upside for TSLA, making the upcoming third-quarter earnings report on October 22, 2025, a key event for investors.