As we kick off 2026, Tesla ($TSLA) investors are buzzing with anticipation. Tomorrow, January 2nd, the company is set to release its Q4 2025 delivery figures, a metric that often sends stock prices on a rollercoaster ride. But let's be real: these numbers, while important for short-term sentiment, are a minor distraction in the grand scheme of Tesla's transformative trajectory. With the recent dip in TSLA shares, from a high of $489.88 on December 16, 2025, to around $450 by year-end, the delivery impact is already priced in, as most investors expect the company to miss the mark with around 440,900 vehicles delivered, down 11% year-over-year.

Tesla had a nasty year in 2025, marked by incidents of vandalism and arson against its vehicles and facilities, often linked to backlash over Elon Musk's political involvement, which let's be honest, scared a lot of people away from buying their first EV. The real story lies in the company's push toward autonomy, robotics, and energy dominance. With the full Q4 earnings report slated for January 28th, investors should keep their eyes on the bigger prizes: the rollout of fully autonomous software, Robotaxi expansion, Optimus pre-orders, and energy sector growth.

The Delivery Distraction: Short-Term Noise vs. Long-Term Vision

Don't get me wrong, delivery numbers matter. They reflect Tesla's core EV business, production efficiency, and market demand. Analysts will dissect them for clues on margins, inventory, and Cybertruck ramp-up. But in a year where Tesla is evolving from an automaker into an AI and robotics powerhouse, fixating on quarterly deliveries is like obsessing over a single puzzle piece while ignoring the masterpiece.

Tesla's stock has historically swung wildly on these releases, but savvy investors know the company's valuation hinges on disruptive technologies, not just car sales. Elon Musk has repeatedly emphasized that Tesla's future is in software-driven autonomy and scalable robotics. Tomorrow's figures might spark a knee-jerk reaction, but the January 28th earnings call will provide deeper insights into financials, guidance, and strategic updates. That's where the real signals on progress will emerge.

The True Catalysts for 2026 Growth

Here's what investors should really be laser-focused on this year, complete with forecast numbers and potential stock price impacts based on analyst projections. As of January 1, 2026, TSLA is trading at approximately $450. The following scenarios outline how each catalyst could impact the stock from this current level:

- Fully Autonomous Software (FSD) Release: Tesla's Full Self-Driving software is the linchpin of its AI ambitions. We're on the cusp of widespread unsupervised autonomy, with version 14 or beyond potentially unlocking true Level 4 capabilities by mid-2026, including approvals in Europe as early as February. This isn't just about safer driving, it's the software that powers Robotaxis and enables over-the-air updates that turn vehicles into revenue-generating assets. Forecasts suggest FSD subscriptions could contribute significantly to margins, with adoption rates potentially doubling if unsupervised mode rolls out successfully. Impact on current $450 stock price: medium (steady progress), remain around $490+; high (if achieved, e.g., rapid adoption and regulatory wins), rise to $600+.

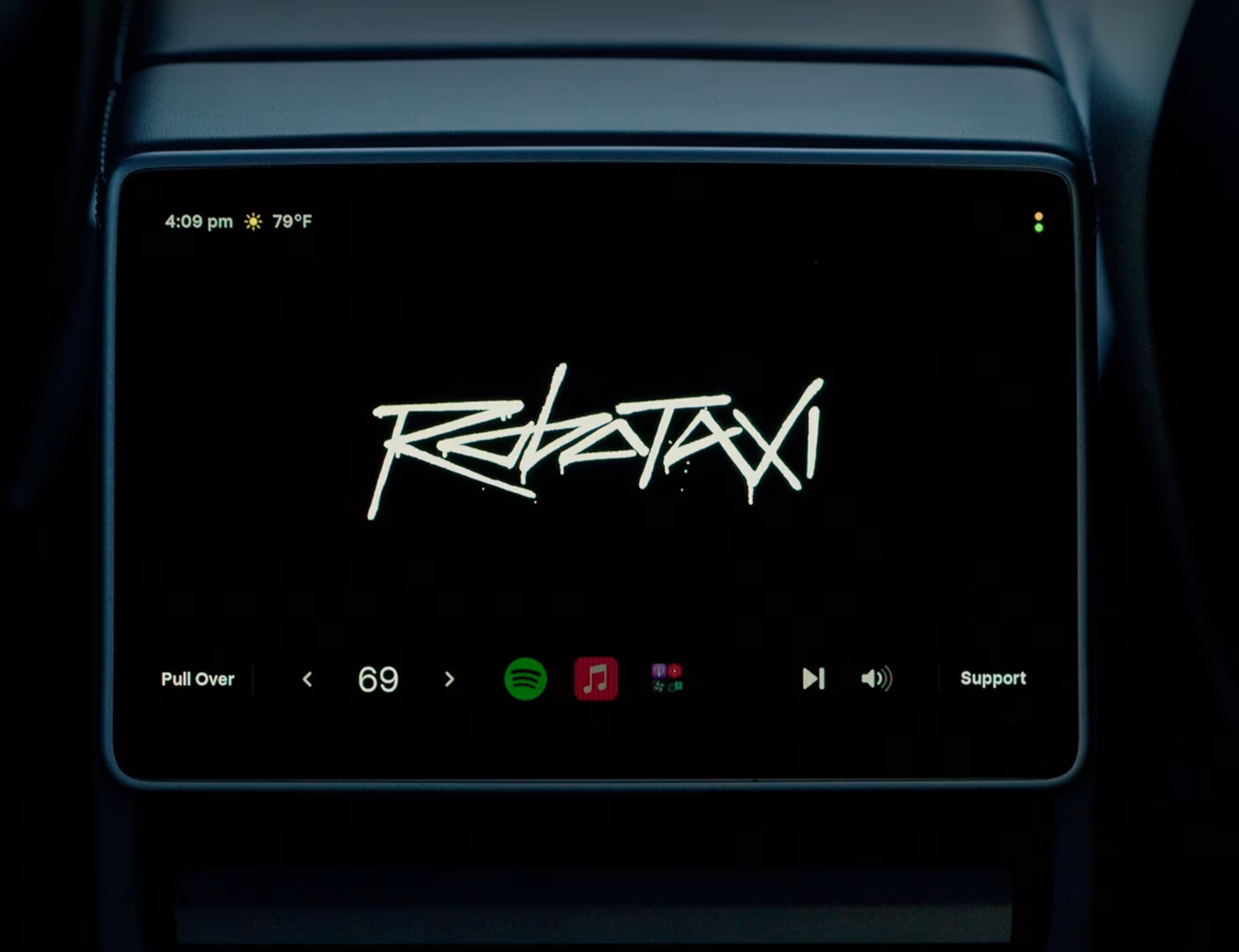

- Robotaxi Expansion: 2026 could be the year Robotaxis go mainstream. Tesla's autonomous fleet has the potential to disrupt ride-hailing giants like Uber, creating a high-margin, asset-light business model. Analysts forecast Cybercab revenues reaching $1 billion in 2026, representing about 1.3% of total revenue, with potential for fleets scaling to over 200,000 vehicles by year-end in optimistic scenarios. Growth here depends on scaling production of dedicated Robotaxi vehicles (like the Cybercab prototypes) and navigating urban deployments. Pre-launch metrics, such as pilot programs in key cities and partnerships, will be key indicators. If Tesla nails this, it could add trillions to its addressable market by tapping into global mobility-as-a-service. Impact on current $450 stock price: medium (modest fleet growth), rise to $500; high (if achieved, e.g., mass deployment), surge to $800+

- Optimus Robot Pre-Orders and Deployment: Humanoid robots are no longer sci-fi. Optimus is Tesla's bet on revolutionizing labor. With pre-orders potentially opening soon and mass production slated for late 2026, investors should track demand from factories, warehouses, and even households. Early adopters like Tesla's own Gigafactories will demonstrate viability, but forecasts indicate limited initial sales, with revenue in the low hundreds of millions as production ramps. The real upside comes from mass production and software iterations. Optimus could address labor shortages in manufacturing and elder care, positioning Tesla as a leader in the $10+ trillion robotics market. Impact on current $450 stock price: medium (factory integrations succeed), remain around $450+; high (if achieved, e.g., pre-orders surge), rise to $900+.

- Energy Sector Dominance: Often overshadowed by EVs, Tesla's energy business is a sleeping giant. MegaPacks, Powerwalls, and solar integrations are scaling rapidly, driven by grid demands for renewables and storage. Analysts forecast energy and storage revenue swelling to $16.86 billion in 2026, up from $10.09 billion in 2024. Look for announcements on new energy projects, like virtual power plants or utility-scale deployments. With global energy transitions accelerating, this segment could rival EVs in revenue, offering stable, recurring income from software-optimized batteries. Impact on current $450 stock price: medium (steady growth), rise to $500+; high (if achieved, e.g., major contracts), surge to $650+.

Overall, analyst stock price targets for 2026 reflect this catalyst mix, with lows around $400 (bearish on execution), medium around $450 (consensus growth), and highs up to $800 or more (bullish on AI breakthroughs). If TSLA hits all its marks in these key areas, the combined impacts could put the stock price above $1000+ by the end of the year, driven by the synergies between autonomy, robotics, and energy scaling.

Why This Matters More Than Deliveries

In essence, deliveries are a lagging indicator of Tesla's past performance—evidenced by the projected second straight annual sales decline to 1.64 million vehicles in 2025, while these focus areas are leading indicators of its future empire. The company's moat, built on AI, data from millions of miles driven, and vertical integration, sets it apart from traditional automakers. Short-term headwinds like competition, economic slowdowns, or even the 2025 vandalism wave might dent vehicle sales, but breakthroughs in autonomy and robotics create network effects that compound over time, potentially driving valuations far beyond current levels.

Another thing we need to watch out for are trade restrictions on rare earth minerals, as we've seen this issue with the U.S. and China before, with China imposing export curbs on critical materials like silver, tungsten, and antimony starting in 2026, which could impact Tesla's ability to meet their goals this year by disrupting supply chains for batteries and motors. As Tesla trades at over 200x consensus earnings entering 2026, the market is betting on these moonshots paying off.

As we await the January 28, 2026 report, remember: Tesla isn't just selling cars; it's building the infrastructure for an autonomous, electrified world. Investors who zoom out will see the forest for the trees and position themselves for massive upside.