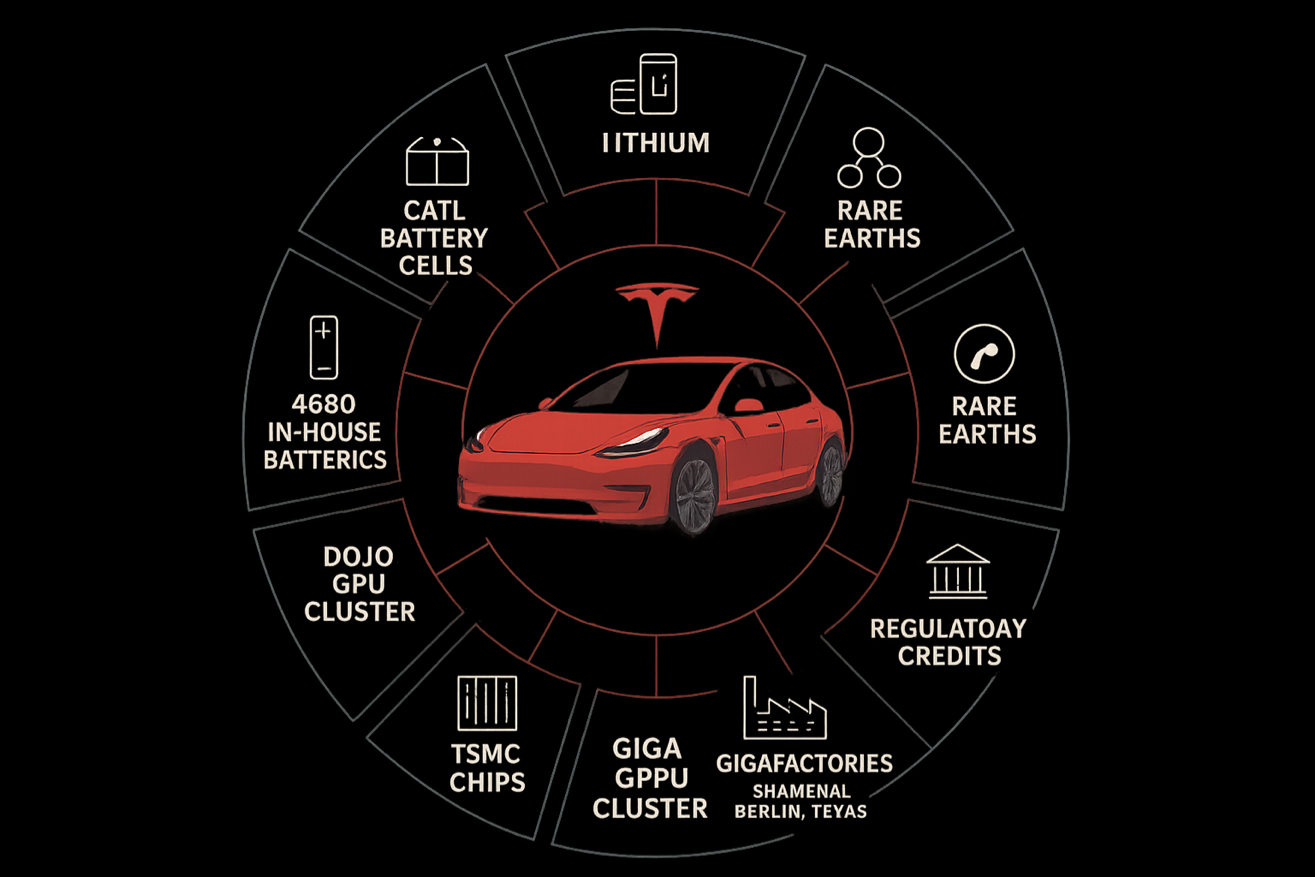

Executive summary: Tesla’s valuation doesn’t hinge on a single breakthrough but on a lattice of nine chokepoints. Consider the water-hungry lithium refinery in Corpus Christi that is slated to draw up to 8 million gallons a day, or the nickel permits in Sulawesi, the scarce 4-nanometer wafer slots at TSMC, and the option-gamma swings inside the SOXX ETF. Each dial, commodity prices, yield curves, tariff headlines, GPU allocations—can tilt margin or multiple within days. Track those gauges in real time and you’ll spot the next ±20 % move long before the sell-side lights up your inbox.

Did you know?

A mid-size lithium hydroxide refinery (like Tesla’s in Corpus Christi) can require 5–8 million gallons per day, about the daily water use of a small city. That’s why water rights, environmental permits, and local opposition are growing friction points in these builds.

Critical Minerals & Raw Materials

Tesla’s new Texas lithium refinery is slated to cover ≈1 million EVs a year and anchor long-term offtakes with Piedmont and Liontown, but the site could gulp up to 8 million gallons of water a day.... a flash point in drought-prone Corpus Christi. A $5 billion nickel pre-pay in Indonesia locks in feedstock where 40 % of world Class-1 supply sits, yet rainforest ESG scrutiny is fierce. Roughly 40 % of rare-earth and cobalt inputs still ride China’s export-licence regime; one stroke of a pen in Beijing would squeeze motor production overnight.

Speculative note: A sudden rare-earth export quota could shave 200 bps off gross margin and echo 2010-style price spikes within weeks.

Battery Cells & Chemistries

Cell supply is a three-headed beast: CATL, LG Energy, Panasonic. CATL alone holds 38 % of global share YTD 2025, so a geopolitically driven shutdown in Ningde would ripple straight into Model 3/Y lines and Megapack queues. Meanwhile Tesla’s in-house 4680 program still scraps 70-80 % of cathodes—burning capital and limiting Cybertruck volumes. Until yields drop below 10 %, dependency on external cells will remain.

Speculative note: If 4680 scrap doesn’t hit single-digits by Q4, Tesla may delay the $25 k car yet again, triggering a multiple-compression rerate.

Compute & Semiconductors

The brains of every new Tesla ride on Samsung-packaged, TSMC 4-nm silicon (HW 5). Foundry capacity is tight, and U.S. export rules on advanced nodes get tougher each quarter. For training, Tesla runs Dojo tiles plus an Austin cluster of 10 000 Nvidia H100 GPUs; Dojo is racing toward 13 exaflops by year-end, but remains an engineering science project. Lead-edge node or GPU allocation hiccups could stall FSD roll-outs and infotainment upgrades.

Speculative note: A CHIPS-Act style cap on Taiwan exports would force Tesla to re-spin HW 5 at older nodes—costing a full model-year.

Manufacturing Footprint

Five gigafactories stretch across three continents, with roughly 50 % of Tesla’s 2024 output still rolling off the lines in Shanghai. Berlin’s planned 250 k-unit expansion is mired in water-use litigation, while the Corpus Christi lithium refinery faces parallel scrutiny over an 8-million-gallon-per-day draw. Nuevo León, Mexico, has slipped again—management now pencils in a phased start-up between 2026 and 2027, pushing the $25 k platform beyond today’s demand cycle. Global dispersion hedges tariff shocks but multiplies permitting risk, currency swings, and labor politics.

Speculative note: Another six-month delay in Mexico would force Tesla to lean harder on Shanghai just as Washington and Brussels re-examine China-focused auto tariffs, adding logistics costs precisely when global price wars are heating up.

Supply-Chain & Trade

Despite aggressive diversification, roughly 39 % of Tesla’s battery raw-material spend still traces back to Chinese suppliers—an exposure that collides with a newly layered U.S. tariff stack. Today that stack comprises a 10 % universal duty, a 20 % “fentanyl” surcharge, and a 100 % Section 301 rate on China-built EVs and many battery components, lifting the effective levy on a Shanghai-assembled Model 3 to about 130 %. On the other side, Beijing’s rare-earth export licenses are now issued in six-month tranches; the latest batch, approved 6 June 2025, could just as easily be yanked if talks sour. Internal scenario work shows that letting the current 90-day 10 % reciprocal-tariff truce expire in August—snapping back to a 34 % baseline or worse—would add 5-8 percentage points to consolidated COGS before any re-sourcing can kick in.

Speculative note: If the truce collapses and China retaliates with fresh rare-earth quotas, Tesla’s margin could compress by double digits long before Wall Street models catch up.

Regulatory Credits & Incentives

The $7,500 Inflation Reduction Act credit now hinges on two filters: at least 60 % of battery components must be built in North America, and at least 60 % of critical-mineral value must come from the U.S. or a free-trade-agreement partner—thresholds many LFP-equipped Models 3/Y still miss. Zero-emission-vehicle (ZEV) and CAFE credits added about $2.8 billion to 2024 EBITDA—less than 3 % of revenue yet roughly 45 % of free cash flow. The House-passed “One Big Beautiful Bill Act” would kill the new-EV credit for most vehicles after 2025 and wipe it out altogether after 2026; Elon Musk blasted the bill as a “disgusting abomination.”

Speculative note: If Congress axes the credit, Tesla must either cut prices again or eat margin in its core U.S. lineup.

Charging & Energy Ecosystem

North American Charging Standard (NACS) is now the default port for Ford, GM, Hyundai, Mercedes and others; Tesla’s network opens to rivals through 2025. Superchargers morph into a toll-road—volume rises, but so do cap-ex and grid-power bills. Utilities already warn of peak-rate increases that could pinch profit per kilowatt.

Speculative note: If regulators impose load-management caps, network EBITDA could undershoot Street targets by half.

Capital & Liquidity Levers

Tesla still taps equity, largely through stock-based compensation that ran $2.9 billion last year, so no debt cliff looms. Yet the multiple trades like an AI option: real yields track inverse to P/E, and semiconductor ETF SOXX option-gamma routinely dictates afternoon tape action. Hedge-fund flow data show tech hardware among the most aggressively bought buckets since May. Liquidity can reverse just as hard, as the recent Trump–Musk spat wiped $150 billion in market cap overnight.

Speculative note: A spike toward 3 % real yields could knock 4-5 P/E turns off TSLA before fundamentals even print.

Demand & Policy

The U.S., EU and China still account for ≈85 % of Tesla unit sales; each region writes its own playbook—fuel-economy mandates in the U.S., battery-passport rules in Europe, subsidy pivots in China. Price cuts cushion demand shocks but shred margin; in Europe, May sales fell 49 % YoY even after discounts. If IRA content tests tighten further, the Model 3/Y’s affordability edge narrows exactly as BYD enters U.S. showrooms.

Speculative note: A stalled U.S. BEV share below 15 % would force another round of cuts and reignite the margin-compression trade.

How a Shock Becomes a Price Move

Suppose 4680 yields stall at 50 %, triggering a cell shortfall that slices Cybertruck output 20 % next Christmas. Management slashes guidance; Street EPS for 2026 drops 40 %. At 40× forward earnings, the stock gaps down 25 %—mirroring the 2016 Model X mis-ramp. Options skew explodes, dealers hedge short gamma, and algo funds dump correlated megacap tech. Within 48 hours, $100 billion evaporates.

Turning the Map into an Edge

Wire in live feeds for 10-yr TIPS, CATL production headlines, Shanghai spot lithium, LME nickel, and Giga Shanghai VIN registrations. Build Z-scores on each and arm pre-set triggers: buy three-month 25-delta puts when lithium + nickel Z > +1 and CATL utilization <90 %. Flip into call spreads when real yields crack 1.5 % and EU duties ease.

Bottom Line

Tesla’s near-term share price still pivots on the “unsexy” dials of lithium throughput, tariff tiers, wafer allotments, and option-gamma in SOXX, but two optionality wedges are now sliding under the valuation stack. First, the Cybercab robotaxi pilot begins in Austin on 12 June 2025 with ~10–20 supervised vehicles, testing a revenue model that could lift fleet-wide gross margin a few points once scale and regulatory clearance arrive. Second, the Optimus humanoid bot moves from lab demo to limited factory deployment this year; Morgan Stanley pegs the humanoid-robot TAM at ≈ $5 trillion by mid-century, and Musk touts a blue-sky $10 trillion sales stream.

Monitor those moon-shots, but remember: until Optimus units ship by the tens of thousands, Tesla’s P&L and any tradable swing will remain most sensitive to commodity costs, policy shocks, and advanced-node silicon. Track those gauges in real time and you’ll still catch the next ±20 % move before the Street’s alerts go off.

Dark Stone Capital View

Dark Stone Capital is shifting Tesla to a slight overweight over the next six months. The move is tactical, aimed at capturing upside from the June 12 cyber-cab pilot, while staying grounded in risk discipline. We’re entering with a tighter leash, adding to the position incrementally on weakness, and keeping exposure capped at five percent of portfolio NAV. If shares rally more than ten percent into July, we’ll reassess and trim back to a neutral weight, especially if margin commentary lags behind the hype.

Looking out three to five years, we see Optimus and Dojo not as hype, but as real optionality. If either scales, Tesla’s earnings power could more than double by decade’s end. Key upside markers include FSD take-rates above 25 percent, cyber-cab revenue beyond Austin, and at least 1,000 humanoid bots deployed in Tesla factories by year-end. The risks are just as clear: real yields rising past three percent, escalating trade tensions, unresolved 4680 yield issues, or a high-profile safety event tied to autonomy or robotics. We’ll reload on any 15 percent pullback that aligns with evidence of margin stabilization in energy storage, but we don’t chase. We scale with conviction, not momentum.