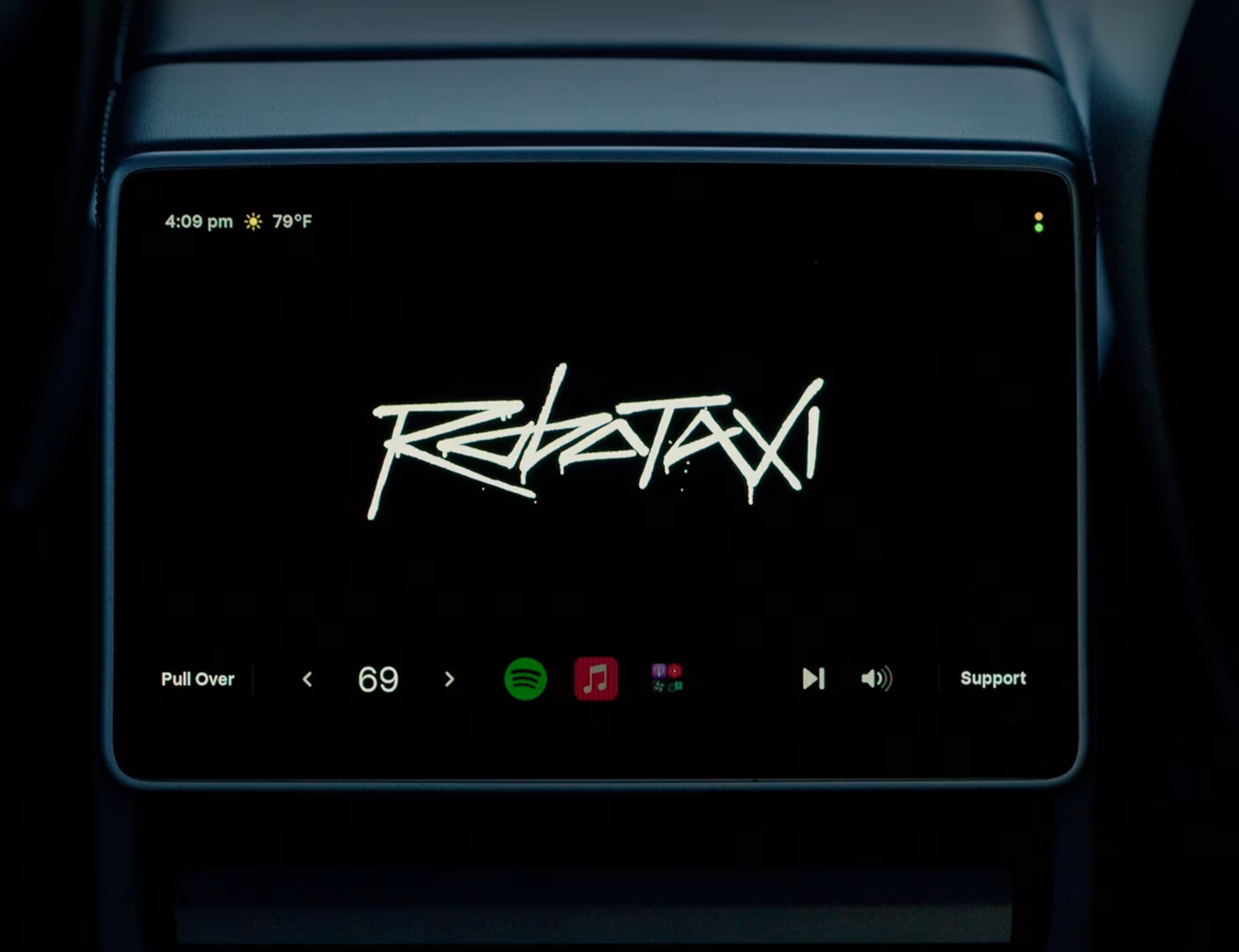

In a recent January 3, 2026, interview with Business Insider, Porter Collins—famous for his role in "The Big Short"—called Tesla (TSLA) the "poster child" for overvalued stocks, citing its nearly 300x forward 2026 earnings multiple compared to Nvidia's 45x. He dismissed it as a "meme stock" driven by hype around Elon Musk's visions for robotaxis, Optimus robots, and Full Self-Driving (FSD), rather than solid fundamentals, especially after Q4 2025 deliveries fell 16% YoY to 418,000 units.

But Collins' analysis misses the mark by viewing Tesla through a traditional auto lens. Tesla isn't just a car company, it's