Executive Summary

The Invesco QQQ Trust is a leading ETF for investors seeking direct exposure to U.S. tech-driven equities. Tracking the Nasdaq-100, it invests heavily in mega-cap companies at the forefront of innovation, especially in AI, semiconductors, cloud computing, and consumer platforms. While this positioning captures significant growth opportunities, QQQ is notably sensitive to economic conditions, interest rates, liquidity, and regulatory developments. As of mid-2025, optimism around artificial intelligence fuels its momentum, but potential risks remain, including earnings misses or restrictive monetary policy shifts.

Understanding QQQ: Key Features and Appeal

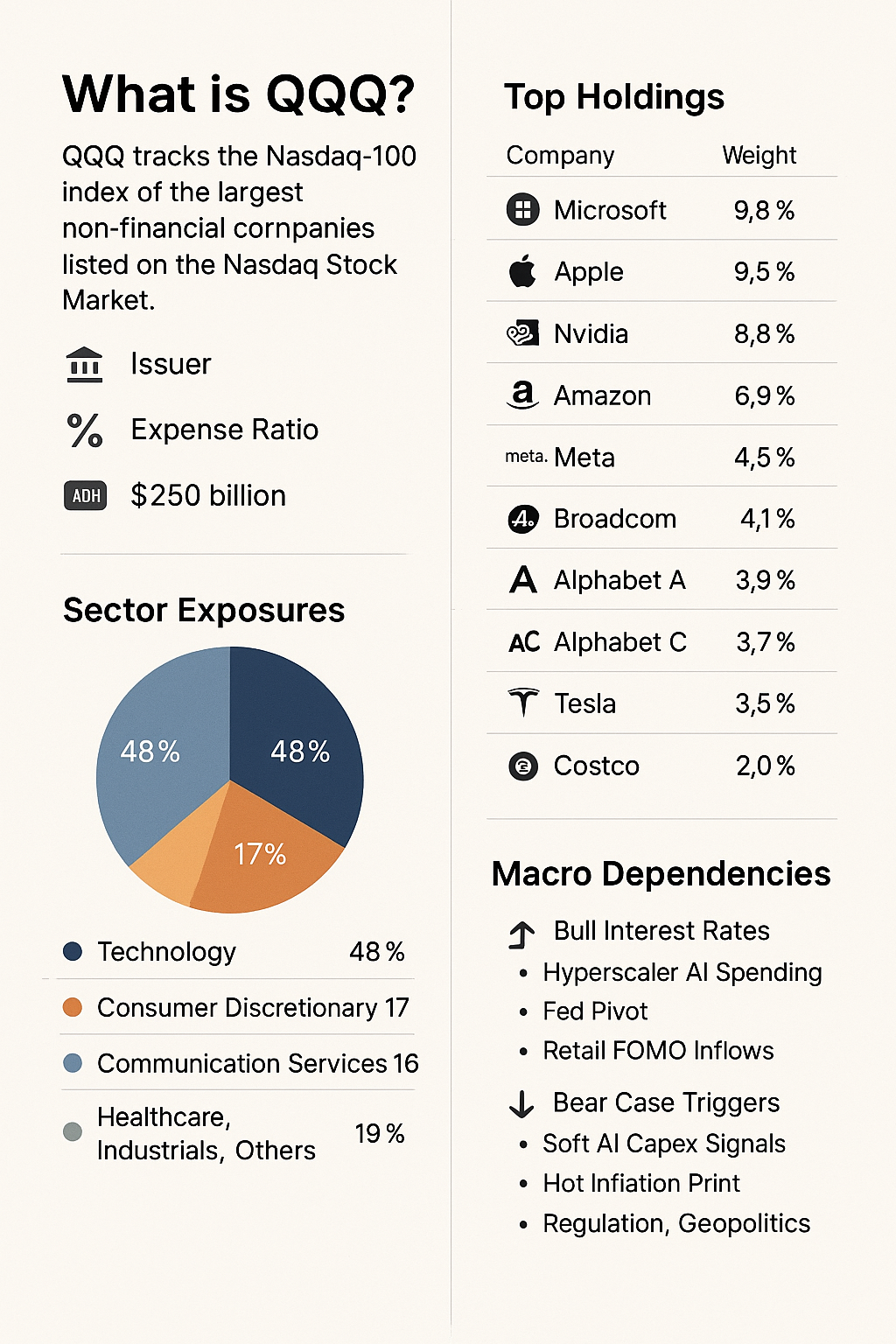

Managed by Invesco, QQQ tracks the Nasdaq-100 Index, holding the top 100 non-financial Nasdaq-listed companies. It ranks among the world's most actively traded ETFs, preferred by retail traders, growth-oriented investors, and institutions due to its liquidity and low-cost structure (0.20% expense ratio). With roughly $250 billion in assets under management and a modest dividend yield of approximately 0.6%, it remains a primary tool for accessing rapid-growth segments of the market.

Dominant Holdings Driving Performance

As of June 2025, QQQ’s primary holdings include industry leaders such as Microsoft (9.8%), Apple (9.5%), Nvidia (8.8%), Amazon (6.9%), and Meta (4.5%). Other significant positions comprise Broadcom (4.1%), Alphabet Class A and C shares combined (7.6%), Tesla (3.5%), and Costco (2.0%). Collectively, these top ten holdings constitute over 55% of QQQ’s portfolio, clearly emphasizing mega-cap growth potential. Notably, financial institutions are excluded by design, focusing purely on non-financial innovation sectors.

Sector Breakdown and Exposure

While QQQ does not formally label itself as a tech ETF, its sector allocations resemble one closely. Technology represents approximately 48% of holdings, with consumer discretionary and communication services accounting for about 17% and 16%, respectively. The remaining 19% spans sectors including healthcare, industrials, and others, providing moderate diversification within its concentrated tech focus.

Macro Factors Influencing QQQ

QQQ's performance strongly ties to broader economic and market factors. Changes in real interest rates notably influence technology valuations, affecting the discount rates on future cash flows. Liquidity conditions, including Federal Reserve policies, fiscal stimulus, and quantitative tightening, also directly impact QQQ’s price dynamics. Regulatory actions—such as antitrust measures against major holdings—and geopolitical risks, particularly tensions involving Taiwan, pose additional substantial threats.

Potential Catalysts and Risks

Potential positive catalysts for QQQ include sustained high investment in AI infrastructure, dovish shifts in Federal Reserve policy, robust earnings reports from its leading companies, and continued retail inflows into tech-heavy ETFs. Conversely, key downside risks encompass reduced AI-related capital expenditure, persistent inflation leading to higher interest rates, intensified regulatory scrutiny, or geopolitical instability impacting critical supply chains.

Current Valuation Metrics

As of mid-2025, QQQ trades at elevated valuation multiples reflective of strong anticipated growth. Its forward price-to-earnings (P/E) ratio is approximately 30x, with a PEG ratio of about 1.8 and a price-to-sales ratio near 6.5. Implied volatility over a 30-day window stands at roughly 20% annualized, indicating heightened market sensitivity. Historically, these valuations are justified by optimistic earnings expectations but remain vulnerable to rapid downward revisions if growth slows.

Who Should Consider Investing in QQQ?

QQQ is best suited for investors who seek direct exposure to technological innovation and substantial growth potential and are comfortable navigating significant volatility—including potential drawdowns of 20–30% during economic tightening phases. Its high liquidity and cost efficiency appeal to investors who prefer index-based strategies over active stock selection. Conversely, those requiring defensive positioning, stable income, or broader sector diversification should consider alternatives.

Historical Performance Insights

Historically, QQQ has demonstrated significant outperformance relative to the broader market, substantially surpassing the S&P 500 returns in recent years. In 2025 year-to-date, QQQ has gained 18.4%, compared to 9.7% for the S&P 500. Its returns in 2024 and 2023 were notably robust at 53.6% and 39.0%, respectively. However, substantial historical drawdowns, including the COVID-related decline (-28%) and the dot-com crash (-82%), underline its vulnerability during adverse market periods.

Advisor’s Note

QQQ remains a compelling investment vehicle for accessing innovation and growth in the U.S. equity market. Nonetheless, it carries inherent volatility and exposure to macroeconomic and regulatory risks. Investors should proactively manage their position sizes, stay alert to changing market conditions, and utilize QQQ primarily as a growth-focused component of a balanced investment portfolio rather than as a defensive holding.