A Glimpse into 2030: From Factory Floors to Family Rooms

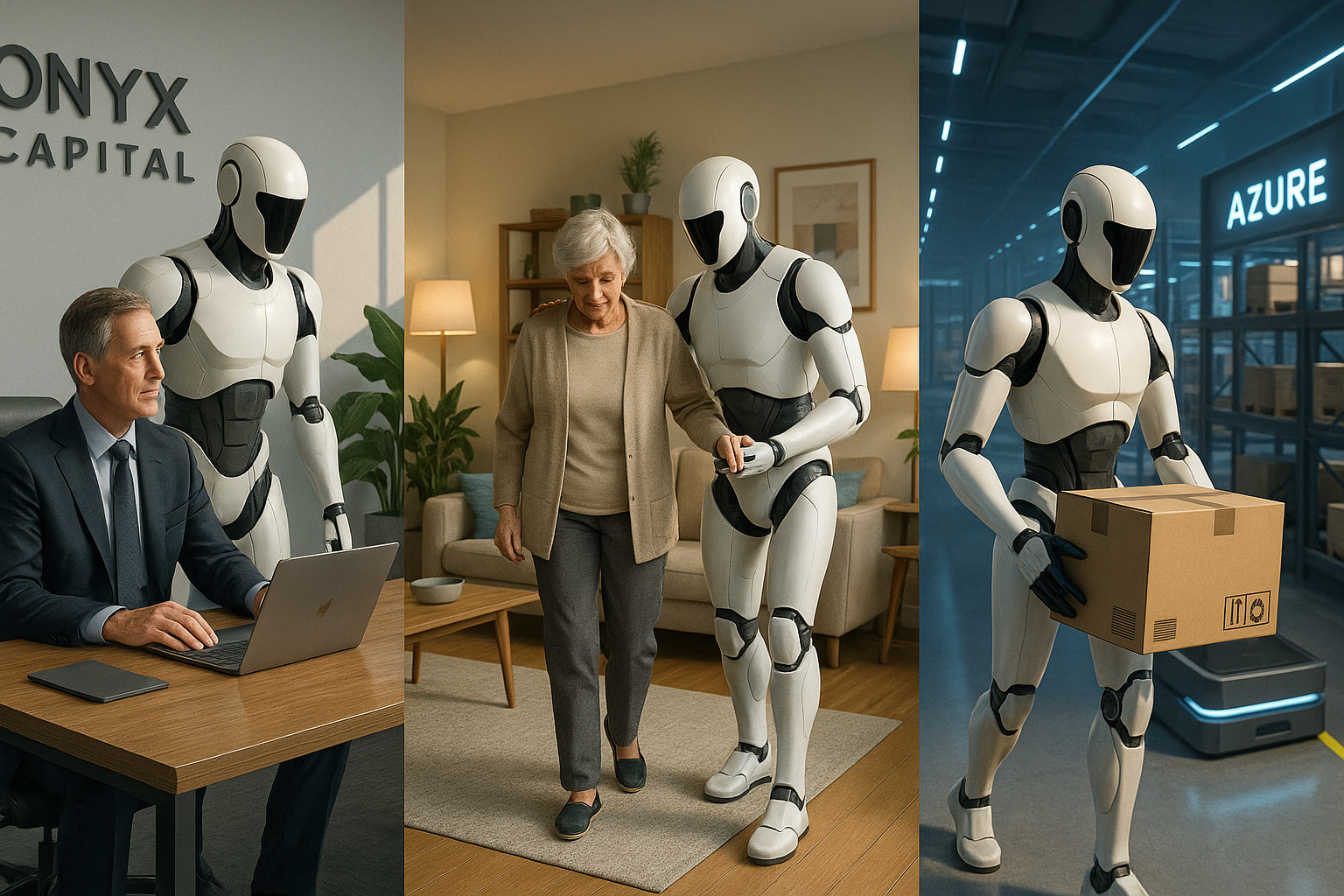

Imagine walking into a friend’s home in 2030. A humanoid robot answers the door, politely offers you a drink, and returns to the kitchen to finish dinner. In the background, another bot is folding laundry while softly interacting with an elderly parent, reminding them to take medication. This isn’t a fantasy. It’s a logical outcome of where humanoid robotics is heading: away from novelty, toward indispensable labor in both industrial and personal domains. By 2030, humanoids will not just be factory workers, they’ll be coworkers, caregivers, and in many cases, part of the household.

Why This Is a “Model‑T Moment”

In 1908, the Ford Model T revolutionized transportation, but it wasn’t the first car, nor was it technically the best. What it did was signal that cars were viable, scalable, and capable of transforming daily life. Humanoid robotics in 2025 is at that same threshold. The prototypes are here. The first use cases are working. But we’re still early, no single platform dominates, interoperability standards are emerging, and most deployments remain in tightly controlled environments.

The real opportunity now lies in measured experimentation. Early adopters, both investors and operators should be testing systems, gathering performance data, and building infrastructure that remains relevant no matter which vendor wins.

The Coming Boom: Market Size and Strategic Importance

Most forecasts agree: humanoid robotics is set to become a $30–150 billion industry by 2035, with further growth beyond that. Goldman Sachs and BCG place the total addressable market near $38 billion by early next decade, while longer-range projections from Morgan Stanley estimate an ecosystem worth as much as $5 trillion by 2050 when you include software, sensors, cloud orchestration, and maintenance contracts.

What’s driving this? A convergence of falling battery and actuator costs (driven by the EV boom), rapid progress in AI for motor control and spatial reasoning, and intensifying global labor shortages, especially in logistics, healthcare, and eldercare. Simply put: robots are getting cheaper, smarter, and more necessary.

The Key Players Defining the Next Decade

In the United States, Tesla is arguably the most ambitious contender. Its Optimus bot is already in live testing inside its Gigafactories, with Elon Musk framing it as a $25 trillion long-term opportunity. While much of that is aspirational, the fact that Tesla controls its battery supply, AI compute (via Dojo), and manufacturing scale gives it an edge few others can match.

Figure AI, backed by Microsoft, OpenAI, and Jeff Bezos, has surged ahead with a full-scale humanoid (Figure 02) now working in BMW’s Spartanburg plant. It’s the first robot of its kind to integrate directly into a live automotive production line, a breakthrough many expected would take years longer.

Agility Robotics, in partnership with Amazon, is building robots for warehouse and doorstep delivery. Unlike others, Agility is laser-focused on logistics, already testing robots that unload trucks and stack shelves. Apptronik, based in Austin, is taking a modular approach with its Apollo robot, targeting multiple sectors and partnering with Mercedes-Benz and NASA. And Boston Dynamics, now under Hyundai, is working on a fully electric version of Atlas designed for heavier industrial use, though no commercial launch has been set.

In China, a wave of well-funded players are targeting price leadership and volume. Unitree Robotics claims it will mass-produce humanoids for under $20,000 by 2025—less than one-tenth the cost of many Western counterparts. Fourier Intelligence is pushing into healthcare and rehabilitation robotics, while UBTECH is already piloting factory co-bots with automakers like BYD and FAW. Xiaomi is entering the space too, leveraging its AI and consumer electronics expertise to explore general-purpose household robots.

At the national level, China is investing heavily with over $130 billion allocated to robotics development over the next two decades, with centralized research hubs, export incentives, and domestic supply chain subsidies. This mirrors their EV strategy and could make China the global leader in robot manufacturing volumes by 2030.

Where These Robots Will Work: Sector-by-Sector Breakdown

Logistics is expected to be the earliest and most scaled application. Warehouse humanoids will load and unload trucks, move packages across fulfillment centers, and operate alongside conveyor systems—especially where wheeled AMRs (autonomous mobile robots) fall short.

Manufacturing will follow quickly, with robots performing repetitive, low-precision tasks like kitting, material handling, and basic assembly. Companies like Figure and Apptronik are already piloting these applications, with the goal of displacing temp workers on night shifts or during labor gaps.

Healthcare and eldercare offer a massive long-term upside. Robots like Fourier’s GR-1 are being tested for rehabilitation and bedside assistance. In aging societies like Japan, Korea, and parts of Europe, the economic imperative is strong: robots can assist in lifting patients, delivering meals, and monitoring vitals. They won’t replace nurses—but they can make every nurse 2x as effective.

Retail and customer service will see slower, but steady adoption. Think humanoids that greet customers, restock shelves, clean floors, and escort guests. These aren’t sci-fi androids—they’re pragmatic helpers, capable of handling the same routine tasks human workers do today.

And then there’s the home. By 2030, it’s entirely plausible that a $15,000 humanoid becomes the new dishwasher or Roomba—a high-end appliance that cooks, cleans, fetches groceries, and keeps elderly parents company. With enough reliability and affordability, these robots could become integral members of the household. For dual-income families, elderly caregivers, or tech-forward urbanites, they won’t just be tools, they’ll be part of the family.

What the Future Market Will Look Like

By 2035, we’re likely to see three distinct tiers emerge:

- High-end, vertically integrated platforms—robots built and serviced end-to-end by companies like Tesla or Hyundai. These will dominate large enterprise deployments.

- Specialized, modular robots—from companies like Apptronik or Fourier, adapted to specific industries and powered by third-party AI software.

- Low-cost mass market bots—produced by Chinese firms like Unitree or UBTECH, used in homes, emerging markets, or low-margin service roles.

Subscription models will likely dominate. Rather than buy a $20,000 robot outright, customers will lease it under “Labor-as-a-Service” plans—just like how most enterprises use cloud software or IT hardware today. Robots will be bundled with software updates, remote monitoring, and guaranteed uptime. SLAs (service-level agreements) will become standard.

What Needs to Happen First

Before humanoids can go mainstream, a few challenges must be solved. Reliability remains an issue: robots still struggle with unpredictable environments and require frequent human intervention. Battery life needs to support full shifts. Vision systems need to reach warehouse-level precision in low light or cluttered scenes. And above all, costs must fall, ideally below $5 per hour of operation to compete with human temp labor.

These are solvable problems. If the last decade of AI and robotics has taught us anything, it’s that progress compounds. What looked impossible five years ago is now happening weekly in pilot labs around the world.

Looking Ahead: What to Watch

If you're an investor, builder, or policymaker, watch the KPIs that matter: cost per task, task-minutes per failure, and remote operator dependence. Follow the capital flows, pilot results, and especially software updates, many of the key breakthroughs will happen in code, not just hardware.

Be skeptical of flashy demos. The robots that quietly work 12-hour shifts without breaking are the ones that will reshape economies.